- ECONOMIC IMPACT -

Latest update: 11 September 2020

The number of cases continues to soar, surpassing 27 million confirmed and 900,000 deaths. The US has recorded the highest number of infections, with nearly 6 million cases. Many countries are also experience a resurgence of cases.

Real GDP growth is expected to bounce back in 2021 if the virus’s spread is controlled by the end of the year. If a second wave of infection spreads, the economic damage will be significant, and the recovery will take much longer.

-3.9%

2020 consensus forecast for world GDP growth is now -3.9%. The pandemic had a more significant impact on GDP in H1 2020 than first anticipated.

$12tn

The global economy is expected to lose $12tn over the next two years. Unemployment is also expected to soar in 2020 but recover slightly in 2021.

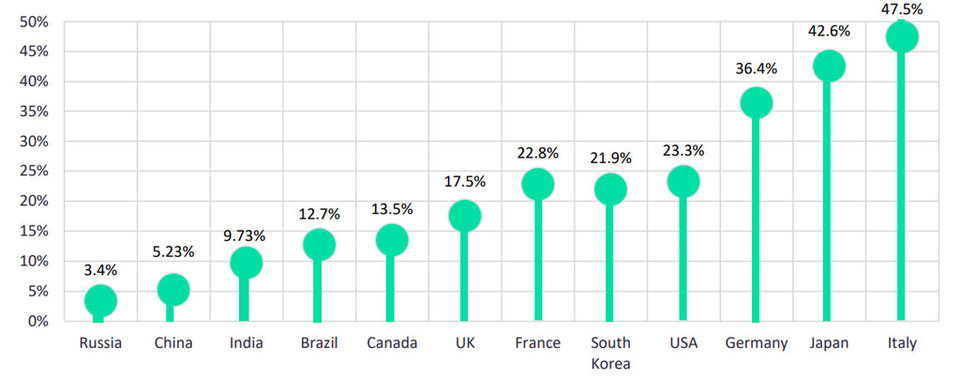

COVID-19 response: stimulus package (% of GDP)

- SECTOR IMPACT: Enterprise Technology & Services -

Latest update: 9 September 2020

$1bn

Revenue impact

Real revenue impact is still unclear and inconsistent. However, companies are preparing for a downturn in planning.

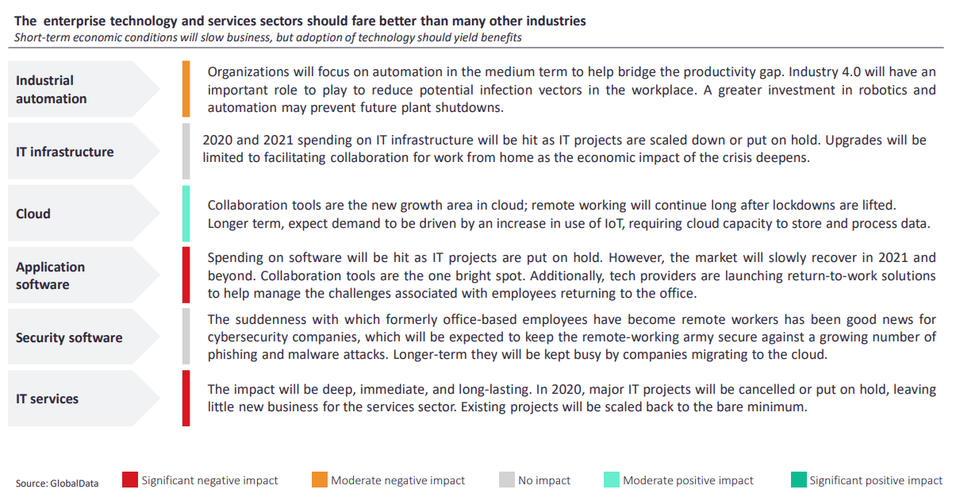

Cloud services are growing exponentially, but many other IT infrastructure and services projects are stalled. IT services are the hardest hit as projects are re-evaluated.

A shift to homeworking has sparked demand in collaboration tools. However, there are associated risks with cybersecurity.

Unemployment

Some enterprise technology companies are reporting executive pay reductions and scaled-back recruitment, but wide-scale Covid-19-related job cuts have not yet materialised.

Cutbacks are inevitable at some point in certain areas.

Conversely, Cisco, Salesforce and other leading tech companies are proactively stating a no job-cut policy, and advocating that position. But many IT services companies are re-skilling employees to adapt to shifting demand and cutting use of contractors.

Supply chain and demand disruption

Apple, Samsung and many others have experienced significant supply chain disruption. Expect significant supply chain diversification in the medium-term.

Enterprise IT saw a rapid and intense demand spike for networking and capacity services, collaboration software and cybersecurity. However, many other IT projects are delayed or cancelled.

While tactical enterprise digitisation efforts surged as a result of Covid-19, more ambitious plans could be delayed by two to three years.

Being a force for good

IT companies that are normally keen competitors are working together with governments by providing AI, compute and other resources. Meanwhile, cloud service providers are prioritising capacity for healthcare, emergency and education requirements and enterprise technology and IT services providers are adjusting pricing and offering free services to help alleviate economic pressure.

Vendors are also launching solutions to help enterprises implement safety measures and manage the return of employees to the workplace.

Response to supply chain concerns

The US Department of Defense has initiated steps to keep cash flowing, specifically via the acceleration of payments through prime contracts and expediting payments to subcontractors. The Australian Department of Defense and UK Ministry of Defence have also instigated similar measures to support their own supply chains.

Sub-sector impact of Covid-19